Are you familiar with how to use certified payroll reporting software? Read on for greater detail about how to get started.

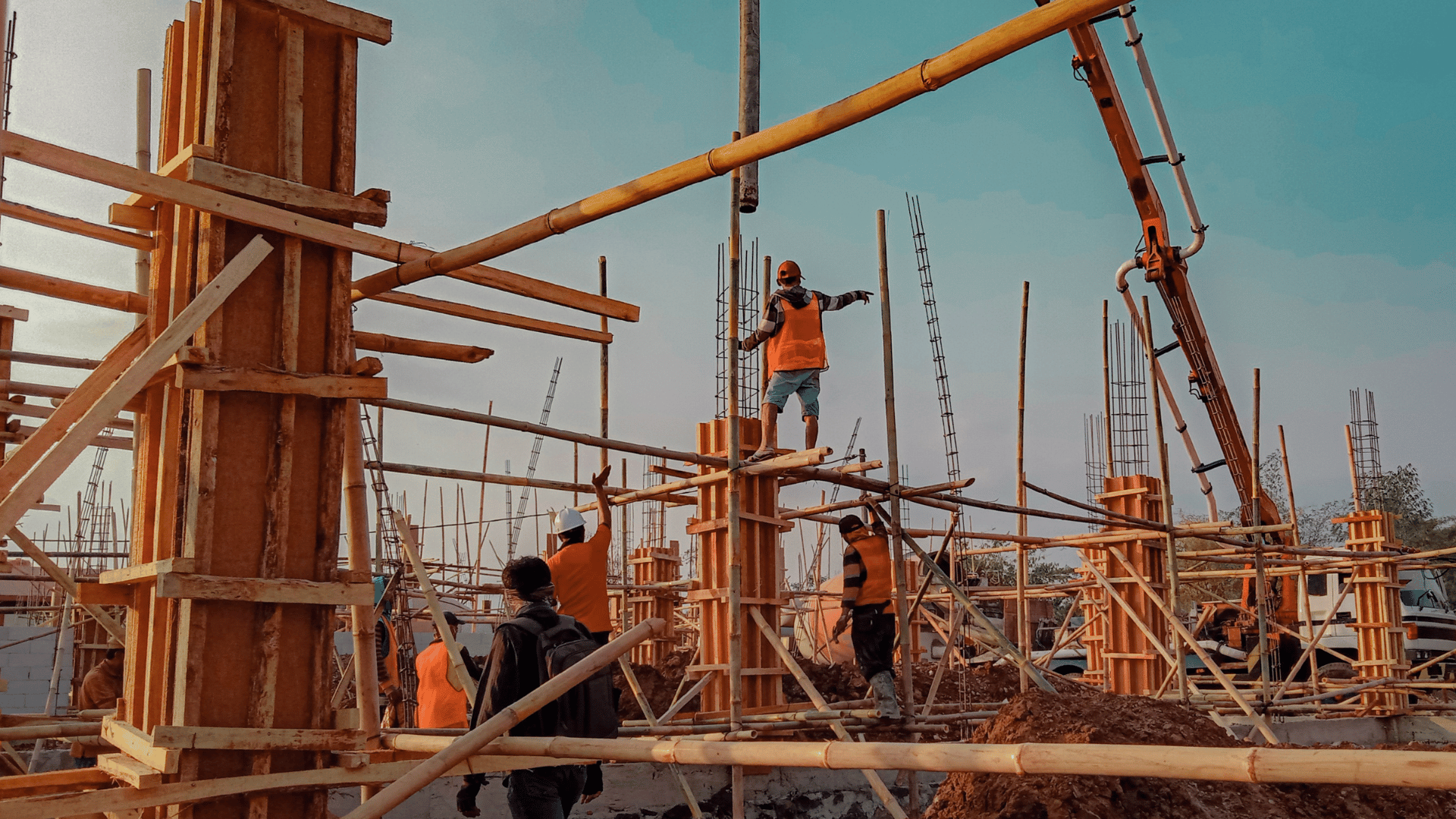

Anyone who has performed work under a government contract knows the importance of certified payroll reports. These reports ensure that workers are being paid properly and that all taxes and other required deductions are being taken out. Unfortunately, preparing these reports can be time-consuming, particularly for companies that have never done it before.

Fortunately, software is available that can automate much of the process. This software makes it easier to prepare the reports and ensures that they are accurate.

This article will discuss the details on how to get started using this software. We will also provide information on some of the best available software options.

What Is Certified Payroll Reporting Software?

Certified payroll reporting software automates and keeps track of the payroll process for you. It also ensures compliance with government regulations. For example, in the United States, businesses that contract with the government must submit certified payroll reports.

This report includes employee wages, hours worked, and other important data. Certified payroll reporting software can help businesses track this data and generate accurate reports quickly and easily.

In addition, the software helps businesses avoid potential penalties. Ultimately, this software saves businesses time and money while helping them avoid costly mistakes.

Requirements for Certified Payroll Reporting

There is specific information that must be reported by companies working under a government contract. They are:

- Each employee's name, Social Security number, and address

- The employee's classification (e.g., electrician, laborer, carpenter, etc.)

- The number of hours worked by the employee during the pay period

- The employee's regular hourly rate of pay

- The overtime rate of pay, if applicable

- Any piecework rate of pay, if applicable

- How many hours worked at each rate of pay

- The gross wages earned by the employee during the pay period

- The deductions made from the employee's wages (e.g., taxes, insurance, etc.)

- The net wages paid to the employee

And there is specific information that the employer must report as well. Payroll reports commonly include the following:

- The contact information of the employer

- The employer's federal tax identification number

- The period covered by the report (e.g., week, month, etc.)

- The signature of an authorized representative of the employer

Now that you understand the basics of what is required, let's look at how the right software can help your business file these reports. And how the right software can help you stay compliant.

Ensure Compliance With Government Regulations

Certified payroll reporting software helps ensure compliance with government regulations by automating the payroll reporting process. The software can generate accurate reports that meet all government requirements.

The software helps businesses keep track of employee hours worked, wages earned, and taxes withheld. This can help ensure that employees are paid correctly and that all withholding taxes are remitted to the correct government agencies.

Additionally, as the laws change, the software can be updated to ensure you're still compliant. This makes life much easier for businesses to worry less about penalties and focus on more important things - like running their business.

Are There Any Other Benefits to Using Certified Payroll Reporting Software?

Payroll reporting compliance can be a challenge for any business. Failing to obey regulations can result in significant penalties. And the process of ensuring compliance can be time-consuming and complex.

Certified payroll reporting offers a solution that can save businesses time and money. By automating the payroll reporting process, certified payroll reporting increases report accuracy. In addition, this eliminates duplicate data entry and offers fringe benefit reporting.

In addition, certified payroll reporting provides a compliance statement that helps avoid penalties. As a result, certified payroll reporting is an essential tool for any business that wants to comply with government regulations.

Getting Started

The software learning curve can be considerably shortened if you select a provider that offers an implementation service that includes a dedicated specialist. With a little patience and practice, you'll be able to navigate the system with ease. Here are a few tips to get you started:

First, take some time to familiarize yourself with the software's interface. Then, explore the different features and options that are available to you. Once you understand how the software works, you can begin entering data into the system.

It's important to enter data accurately to ensure that your reports are accurate. Pay close attention to detail and double-check your work before moving on. If you make a mistake, correcting it can be time-consuming.

Finally, generate your report and review it carefully. Ensure that all of the information is correct and that everything is in order. Once you're satisfied with the results, you can submit the report for approval. With a little effort, you'll be using reporting software like a pro in no time!

Frustrated With Trying to Keep up With Prevailing Wage Reporting?

Points North was created to help you overcome the challenges of payroll reporting. Our certified payroll reporting software is designed to automate the process and reduce manual workflow, so you can focus on your business.

Accurate reports are essential for compliance, and our software offers increased accuracy. Plus, our easy-to-use platform eliminates duplicate data entry and saves time. That means a positive impact on your bottom line. And if you need fringe benefits incorporated into the report, we've got you covered there too!

Sign up for a free demo today and see how Points North can make certified payroll reporting simple and stress-free!