Contractors have a lot to gain by working with the government. One way of to gain access to government contracts is by bidding for them online. Governments subsidize a business' project costs, which is partially why there has been a rise of contractors bidding for different contracts.

Contractors use databases to locate government contracts for bidding. Government agencies also use databases to find contractors.

Each year, the American federal government spends billions procuring contracts. There is a lot of money to be tapped into by starting to accept government contract work.

Before bidding, it is important to understand the different kinds of government contracts. Federal government contracts have standards that a contractor is expected to meet, including compliance requirements such as certified payroll reporting.

Let's go over the different types of government contracts you might see in your bidding, and what the differences are.

1. Fixed Price Contract

In this contract, the seller receives funds in a lump sum. This government contract is great for instances where the contractor has determined the estimated costs of items and services.

By receiving funds in a lump sum, the contractor will agree to bear some risks. For instance, there are cases where a contractor may need additional funds if a disaster strikes such as construction materials like plywood or windows getting destroyed by a storm. This contract will bar the seller from asking the government for additional funds to buy damaged materials.

For this arrangement, the contractor will seek ways of spending less money from the funds received. Initially, the law required contractors to have a physical office, but this was suspended.

2. Time and Material Contract

This contract is for sellers who do not know the cost of buying certain materials or hiring labor. As a result, the government dictates the price of labor hourly. The contractor will then provide the government with labor while the government looks for construction materials.

Since this contract tends to be short-term, some contractors get reluctant to bid for this contract. There is a chance that some workers may never get hired, since in some cases specific circumstances need to arise for the government to seek labor.

This contract is also sought when it is impossible to estimate a project's completion date.

If the government feels your project may succeed, then they will agree to work with you. However, in several instances, the government may not want to bear the risk of funding a project without a set deadline.

3. Cost-Reimbursement Contract

This contract is the opposite of a fixed-price contract. For this contract, a contractor is awarded a pre-determined amount alongside additional fees. The contractor can therefore use the extra funds should materials get lost or destroyed.

In this contract, the contractor receives funds from the government. The contractor then pays for costs for labor, tools and materials. After a project is completed, the contractor then gives back some money to the government.

The contractor receives funds for both direct and miscellaneous costs.

Direct costs cater specifically for the project, such as labor and materials. Miscellaneous costs extend beyond the project, for instance, manufacturing facilities and head office costs.

For the contractor to reimburse the government, the project should not be a white elephant. A contractor must therefore be certain that the project will bring in returns. The reimbursement, however, is not unlimited.

4. Incentive Contract

In this agreement, the government motivates contractors to offer quality work through rewards. The incentive is, in most cases, a bonus payment. Incentives are also given to contractors who finish a project before the deadline. These contracts can occasionally be more extreme in their needs and timeline.

5. Indefinite Delivery & Quantity Contracts

Sometimes a government agency may not be sure what they need. As a result, the government may buy a random number of supplies hoping that they will complete the project.

This project requires workers to be available at all times. For instance, if an engineer bought few faucets for a school, they will be asked to buy more.

Choose the Types of Government Contracts You Need

Regardless of the contract you choose, make sure you understand the requirements that are being asked of you. Before you bid, ensure that you have a proper plan when submitting your certified payroll reports. These reports prove you are paying your workers fairly. For the government to determine this information, you will need to submit federal reports to them. Employers have the option to complete their certified reports manually or they can utilize a software to complete the reports for them.

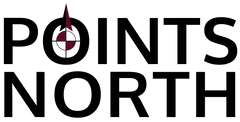

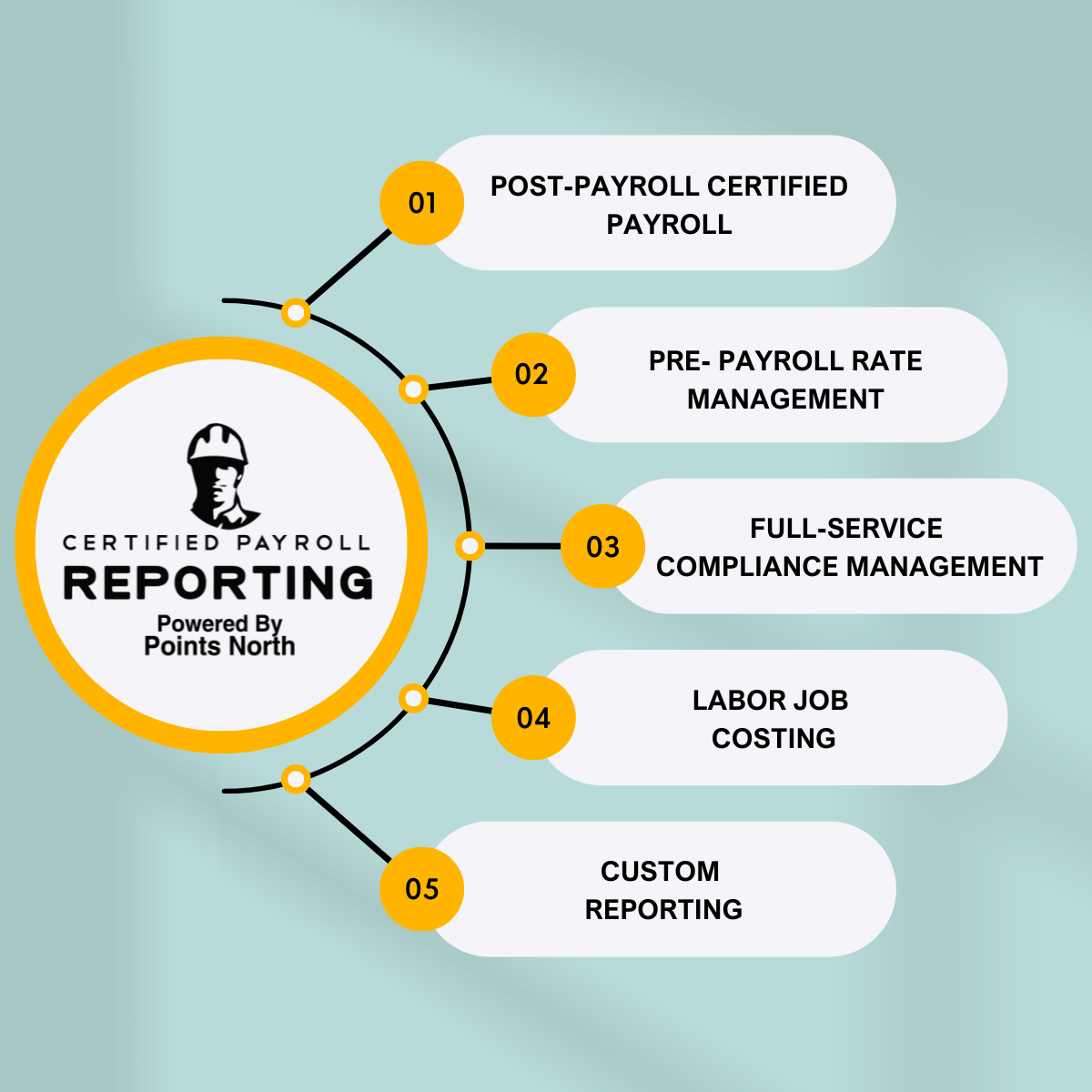

Here at Points North, we offer you a simplistic way of reporting. You do not need to miss out on a government contract because of certified payroll reports. We will streamline the process for you and ensure your company is compliant with all government regulations.

Contact us today, and we will solve your reporting problems.

.png)