Several states have their own mandates and requirements for ACA Reporting. As a result, the process of ACA reporting can be complex. Luckily, we are here to help you navigate these individual state ACA mandate differences!

Currently, the following states require state-level reporting of employers' ACA information:

New Jersey

The state of New Jersey requires ALEs to file their ACA information with the state in addition to filing with the IRS. This responsibility includes providing 1094 and 1095 forms to the state while also meeting the federal filing and 1095 distribution requirements. The New Jersey filing deadline is March 31.

California

Similar to New Jersey, California requires ALEs to submit their ACA information to the state's Federated Tax Board each year. Additionally, the state of California has retained the January 31 deadline for the distribution of 1095 forms to employees.

Washington D.C.

According to Washington DC, ALEs are required to provide coverage information to the Office of Tax and Revenue (OTR) and they must submit a statement about the coverage type.

Despite being similar to federal filing requirements under the ACA, these requirements are not quite the same. OTR requires all information returns to be electronically filed through MyTaxDC, as paper filing will not be accepted. The deadline for submitting annual reports under this tax guidance is April 30.

Massachusetts

ALEs in Massachusetts do have an obligation to file their ACA compliance information yearly. Those who provide a fully insured plan can fufill this requirement by filing their 1094-C/1095-C with the IRS, while those who offer self-insured plans are required to submit 1099-HC forms to the state of Massachusetts.

This one can get a little confusing due to the way the information is displayed on the state website, so make sure to confirm you are following the updated and correct guidelines.

Rhode Island

Employers in Rhode Island must provide the complete 1095-Cs to employees and file the returns with the state's Division of Taxation (DOT). The ACA reports will need to be uploaded to the state's website and must be filed by March 31

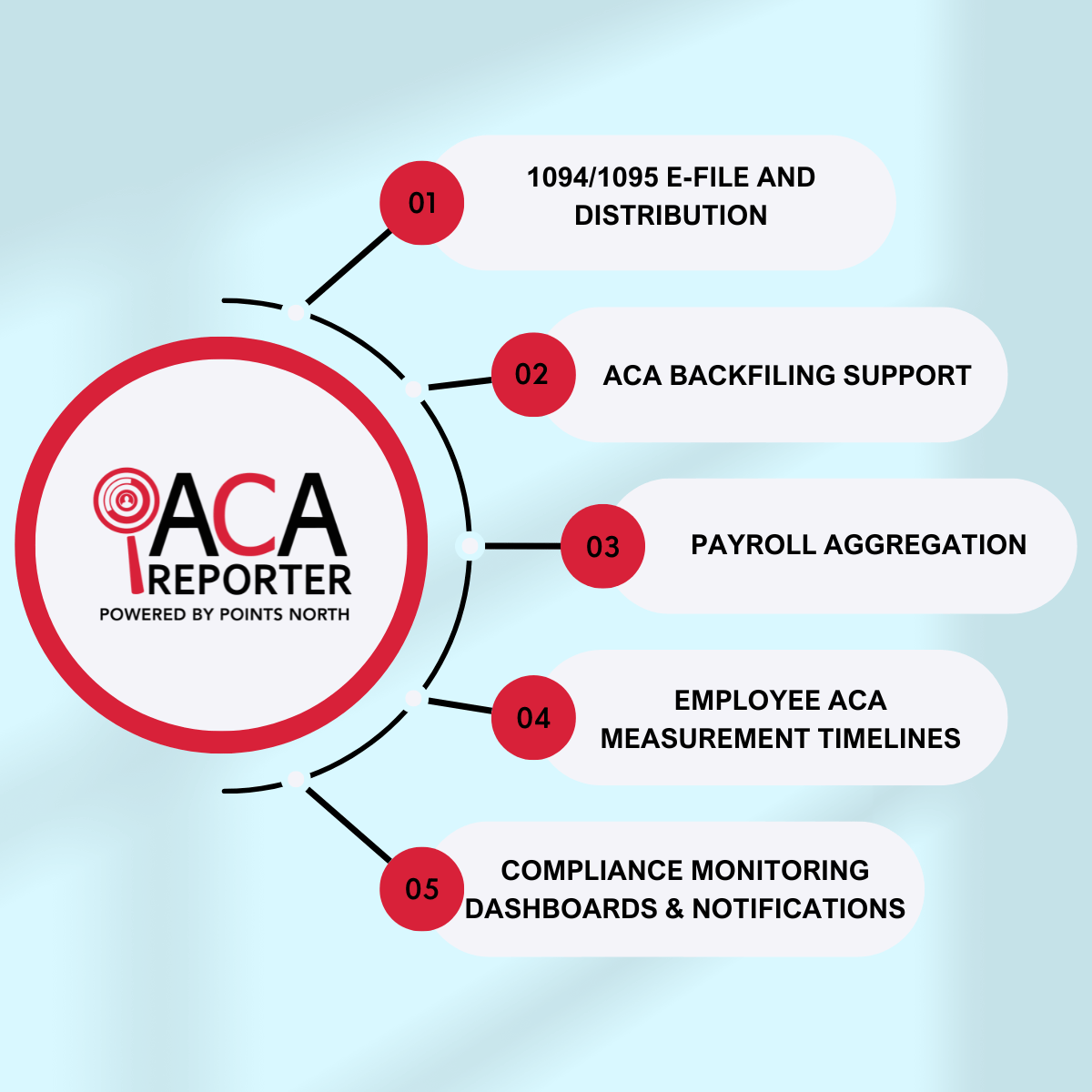

Confused or wanting some help navigating these individual laws? Contact us now to let our experts help you go through the process more effectively. ACA Reporter can help take the complexity out of ACA filings and make ACA compliance easy and streamlined rather than a hassle.

.png)