In 2020, the federal government spent $680 million in contracts. With these contracts came many rules and regulations to navigate.

Construction and labor companies have to complete a lengthy and complex bidding process to secure a government contract. They can expect many benefits if they win, but it also comes with many regulations—like certified payroll reporting. Without assistance, one report can take a company almost an hour to complete.

Keep reading to understand the ins and outs of government contracts, what certified payroll reporting is, and what are requirements and some examples to deepen your knowledge of the subject.

What Is Certified Payroll Reporting?

Certified payroll reporting is a comprehensive accounting document that outlines every cent you pay workers on a government contract. Contractors and subcontractors create these reports to allow the government to view and ensure workers are paid fairly.

Each certified payroll report has outlined information about prevailing wages. The prevailing wage is the hourly rate you pay workers in the same job with similar job duties. (You can visit the Department of Labor website to use their calculator to determine prevailing wages for your project.)

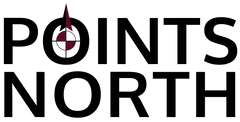

With Points North, our comprehensive, all-in-one certified payroll reporting and prevailing wages solution helps you in several ways:

- Fast report generation

- Simplified process

- Reduce duplications

- Increase accuracy

- Save time

- Easy report submission

- Decrease manual workflows

What are Certified Payroll Reporting Requirements?

Certified payroll reporting requires you to include various information about every employee on the job. The report needs to include:

- Employee name

- Employee ID number

- Job classification

- Hours worked

- Prevailing wage

- Any fringe benefits

- Gross pay earned

- Deductions

- Withholdings

- Net wages

If there are subcontractors on the project, they must first complete their certified payroll reports, then provide them to the contractor so they can be included in those reports.

You must include yourself in certified payroll reports.

Salaried employees are generally exempt from these requirements, but it's best to research if you're unsure who should be reported on.

Government Construction Contracts

Any contractor or subcontractor with a contract over $2,000 must meet certified payroll reporting requirements.

This applies even if the contract isn't fully paid by the government. If there is $2,000 or more in government funding involved, the requirements must be met.

Construction Industry Trends

2020 was a tough year for everyone, and the construction industry was no different. However, by the fourth quarter, companies were seeing an upswing in projects and revenues.

The pandemic brought many changes to the construction industry, including:

- Personal protection for employees

- Remote work for office workers

- Social distancing

- Adjusted delivery schedules

- Changes in wages

There were also many challenges. Ranging from low material supply to worker shortages to project shutdowns and delays.

The Davis-Bacon Act

The Davis-Bacon Act is the law that requires any government funding over $2,000 to have certified reporting.

It applies to any public building renovation or development. And any project that receives assistance, such as insurance, grants, loans, or loan guarantees.

The Act gives the Department of Labor the right to determine local prevailing wages. Prevailing wages are based on the type of work completed and where it is being completed. Wages are combined with fringe benefits (health insurance, paid time off).

There are nuances for certified payroll reporting, and filing and meeting requirements requires more than basic knowledge of QuickBooks. One certified payroll reporting example is for projects valued over $10,000; wages need to be calculated a little differently and any hours worked over 40 must be paid at 1.5 times the regular rate.

Apprentices and trainees enrolled in Department of Labor approved programs are exempt from prevailing wage requirements.

You have to post the Davis-Bacon wage determination poster in an accessible location so all workers can see it.

Successfully Navigating Government Contracts

Before venturing into government contracts, you should thoroughly understand the Davis-Bacon Act, certified payroll requirements, and contract requirements.

Failure to meet expectations and requirements can result in violations, fees, and penalties.

Contract Violations

You can violate contract terms easily and in a few different ways. The following are common violations:

- Misclassification of workers

- Not paying prevailing wages

- Inadequate records

- Not having accurate apprentice documents

- Not submitting weekly certified reports

- Not posting the Davis-Bacon Act poster

Diligence is important in maintaining compliance with government contracts. It can be beneficial to hire an outside company or purchase compliant software to help you manage these requirements and avoid penalties.

Penalties for Failing to Comply with Requirements

There are several consequences for not following the requirements outlined in the Davis-Bacon Act, such as:

- Contract termination

- Holding of funding

- Contractor liability for payments made

- 3-year debarment from government contracts

There are also monetary consequences to failing to comply. If you want to stay in good standing with the government and create a worksite that employees feel confident working at, it's vital you maintain compliance.

It'll also help you to attract good workers.

Generate Certified Payroll Reports Quickly and Easily

Now that you've read about the Davis-Bacon Act and understand certified payroll requirements, are you ready to manage government contracts? Do you have the time and resources to manage the requirements, create weekly certified payroll reports, and ensure you don't have any violations?

Or is the thought overwhelming and a little scary?

If the second answer is yours, you aren't alone. Choosing a third-party option to help you with your compliance is a viable option, and you're in the right place.

If you choose to outsource, you greatly decrease the requirements you have to monitor. With our payroll solution, you can worry less because we ensure every report is compliant.

Are you ready to check out our all-in-one solution that eases the burden of meeting certified payroll requirements? Or maybe you want to view a sample certified payroll report as an example to help inform your decision? To learn how our solution meets reporting requirements, schedule a demo today.

.png)