If you're confused with navigating the nation's healthcare system, you're not alone. The Affordable Care Act (ACA) brought healthcare to millions of people. But it also created more stringent reporting guidelines for individuals and employers.

Understanding the ACA reporting requirements is essential to ensure you stay in compliance with current regulations. This article will tell you what ACA reporting is, when it’s due, and the benefits of using ACA software to handle your business's ACA filing.

What is ACA Reporting?

Every year, individuals and employers need to fill out their ACA reporting forms to follow ACA compliance. The documents detail health coverage for employees during the calendar year. Employers who offer a self-funded insurance plan to their employees fill out Form 1095-B. Applicable Large Employers (ALEs) who provide group health plans to individuals considered full-time employees fill out Form 1095-C.

ALEs have at least 50 full-time employees. When is ACA reporting due for ALEs? Employers must provide their employees with their 2021 individual statements (Form 1095-B) by January 31, 2022. Paper forms (1095-B and 1095-C) for 2021 are due to the IRS by February 28, 2022, and electronic forms are due by March 31, 2022.

Businesses with more than 250 full-time employees must submit electronically. Further, companies can file a request for an extension if necessary.

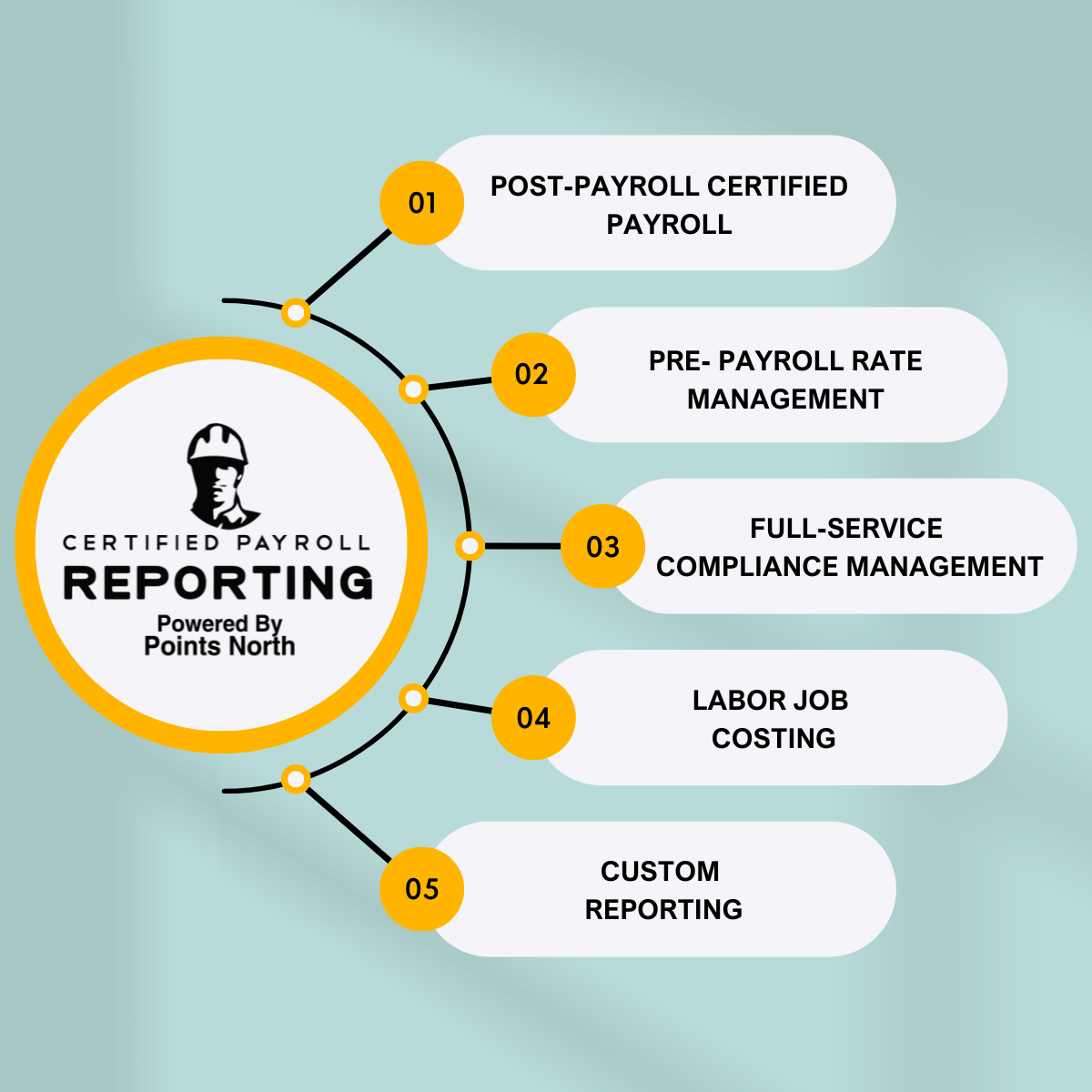

However, businesses, especially ALEs, can use ACA reporting software to assist them instead of reporting manually. So why should your business use ACA software? First, let's look at some of the many benefits.

1. Personalized Employee Profiles with ACA Software

An excellent advantage to using ACA software is the personalized employee profiles. The profiles integrate with your HR system to easily access all up-to-date ACA information for every employee. As a result, you don't have to fear losing essential data. In addition, all the data is secure in the HR system, including ACA reporting information.

Moreover, at any time, a key benefit of using ACA software is that employers can see ACA compliance with just one click. Employers can quickly administer coverage too. In conjunction with the ALEs guidelines, you can use the software to see how many full-time employees you have because HR software also tracks employees' work hours.

ACA software is the next step to bringing all employee information together for effortless access, tracking, and compliance.

2. Easy Eligibility Determination

All of your employees have different health insurance needs. That's why the open enrollment season causes chaos for so many businesses. Yet, with automated ACA software, the system will determine who is eligible for which benefits and healthcare packages.

The software is transparent, so employees know what health insurance they have and what it covers. They can access details about their current package at any time and look at past coverage if necessary.

Neither you nor your employees have to worry about getting the best healthcare accessible through the Affordable Care Act.

3. Up-to-Date Forms and Compliance

Each year, the government can make changes to Form 1095. Using ACA reporting software, you will continually have updated versions. The cloud-based software ensures compliance and adjusts when necessary.

So, it updates the forms seamlessly from behind the scenes. The software makes it easy to print, distribute, and file the forms each tax season.

4. Saves Time

One of the biggest benefits of ACA reporting software is the time it will save you. Of course, you need to file all the forms with the IRS promptly. This requires you to have the correct information like:

- Employer identification numbers (EIN)

- Taxpayer identification numbers (TIN)

- Dependents

- Addresses

- Coverage information

Once you enter the data into the software, it stays safely stored and ready for future use. In addition, you can easily update it from year to year as needed. No more sifting through papers trying to get all the data you need.

The ACA compliance software e-files the documents with the IRS but also allows for multiple EIN reporting. It can submit all the files at once. The law states you need to provide copies of the reporting documents to your employees.

This is a section of the ACA employer reporting requirements. As mentioned, you need to give your employee these forms by January 31, 2022. Distributing the documents is much easier to do with the software because everything is automated. It saves you a lot of time.

Additionally, it eliminates human error, ensures everyone receives their forms on time, and guarantees compliance with regulations.

Plus, your HR team doesn't have to spend countless hours gathering information each year. It's time-depleting and aggravating to get all the data sorted and filed. This leads to stress and confusion when it comes to ACA enrollment and reporting.

5. Saves Money

With how much time you save, you also save money. It would take a full-time team to adhere to compliance standards every year for ACA reporting. The software drastically reduces the cost of paying your employees to collect and file the forms.

Often, outsourcing saves your company money in the long run. This is one of those instances. Not to mention it makes everyone's job easier.

Furthermore, easy to use e-filing will allow you to greatly reduce the chance of penalty fees. Missing the ACA reporting deadline can rack up hundreds of thousands of dollars in costs. It is not something you want to risk having to pay hefty fines due to late filing.

Get Started with ACA Software

As a business owner, the IRS requires you to file ACA reporting annually. Manually filling out the forms is time-consuming and stressful. In addition, there is a lot of room for human error. But, you can choose to integrate ACA software into your HR system for seamless reporting.

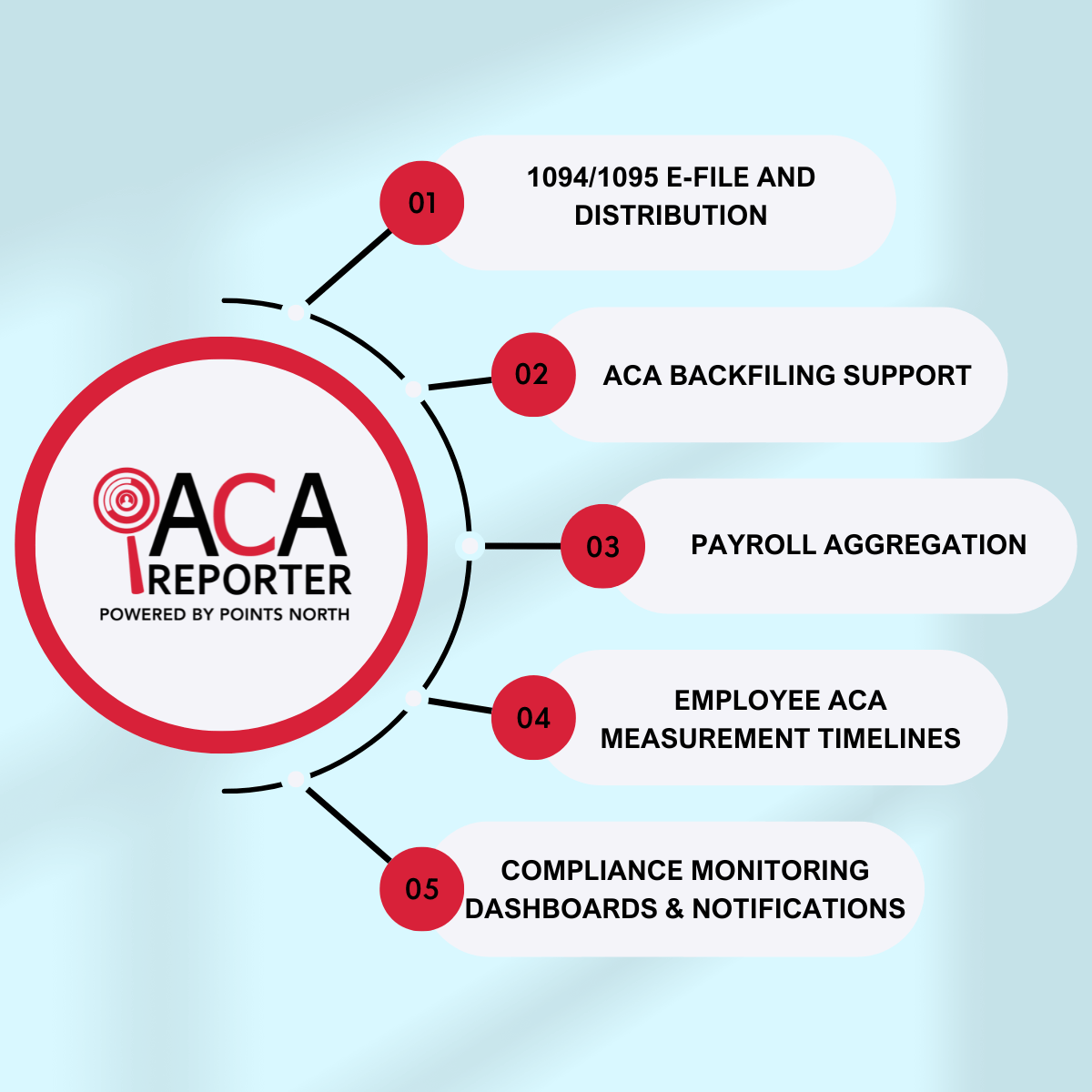

To get started, talk with our ACA professionals at Points North. We can help you set up ACA software at your business to make reporting more manageable than ever before.

.png)