If you are bidding on a contract or already working for a government entity, there are specific requirements to ensure compliance with the Davis-Bacon Act. A requirement is to pay a prevailing wage and to be able to prove so by submitting certified payroll. State laws are different from federal laws. So, it is essential to understand the difference between these laws.

What is the Davis-Bacon Act?

According to the Davis-Bacon Act, contractors and sub-contractors must pay their workers employed under contract no less than the local prevailing wages and fringe benefits for corresponding work on similar projects in the area.

In 1931, the Davis-Bacon Act was passed by Congress, which requires contractors and subcontractors to pay prevailing wages to workers and mechanics on all federally funded construction projects over $2,000.

Why Was The Davis-Bacon Act Passed?

- During the Great Depression, Congress feared that the fierce competition for jobs would result in contractors and workers working for lower wages.

- The Davis-Bacon Act was passed to prevent immigrant and non-unionized black workers from competing with unionized white workers for scarce jobs.

Federal Prevailing Wage Laws

In addition to Davis-Bacon Act, there are almost 60 related acts nationwide, such as the McNamara-O'Hara Service Contract Act, which covers contracts over $2,500. These federal laws affect state and local projects funded partially or wholly by federal funds.

Here are some things to know about federal prevailing wage laws in relation to the Davis-Bacon Act:

- In the past, federal prevailing wage laws mainly applied to infrastructure and transportation projects.

- In February 2014, the U.S. Department of Labor issued a final rule to implement the provisions of Executive Order 13658.

- Executive Order 13658 raised the federal minimum wage paid by contractors to workers to $10.10 per hour beginning in January 2015.

- Davis-Bacon Act mainly applied to construction projects. This new requirement also applies to contracts for goods and services.

State Prevailing Wage Laws

It is sometimes called the Little Davis-Bacon Law. These laws set thresholds for salary requirements. As with federal law, states with prevailing wage laws only apply to construction and specific jobs.

Contractors and subcontractors may think that prevailing wage laws do not apply to them because their project is not funded by the federal government. However, many states have prevailing wage laws that cover state-funded public projects, such as public buildings and roads.

Compared to Davis-Bacon Act requirements, state prevailing wage laws can differ. Examples include:

- Some states are triggered at higher dollar amounts.

- Some states have lower thresholds than federal cut-offs.

- California has an additional requirement that contractors must register with the state.

- Maryland not only includes construction projects but also consists of state-funded businesses.

How Is The Prevailing Wage Determined?

- The U.S. Department of Labor oversees the rules and requirements for the Davis-Bacon Act.

- The prevailing wage law only applies to construction workers in certain types of professions.

- The Department of Labor conducts surveys of wages paid for these specific jobs in surrounding areas and determines prevailing wages to reflect the local economy.

- The prevailing wages are not determined by the state or federal government but by these surveys, consisting of both union and non-union workers. Because of this, a state with higher construction wages will have higher prevailing wages.

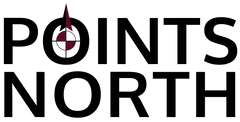

Certified Payroll to Meet Davis-Bacon Act Requirements

Payroll is the nucleus of the workforce. Suppose you are a contractor or subcontractor for a project funded partially or wholly by the federal government. In that case, you must understand all state and federal Davis-Bacon Act prevailing wage laws to correctly submit your certified payroll to the U.S. Department of Labor and the governing body for whom you are doing the job. Failure to submit an accurate certified payroll can result in heavy penalties and loss of contracts.

.png)