If you work with government construction contracts, you know there is always a lot happening within the industry. Right now, in particular, there are a lot of new government construction initiatives and changes. Plus, a lot is happening within the construction market that impacts the construction industry and policies as a whole.

It is important to stay up-to-date with government constitution news to ensure your company stays compliant and can plan and adjust to changes. Keep reading to learn the latest U.S. government construction news.

Biden's Budget Priorities For Transportation

President Biden's 2023 fiscal budget proposal, he requested $142 billion for the construction of highways, tunnels, bridges, airports, ports, railways, bike lanes, and more. If the budget passes, this means a significant increase in dollars will be invested in the transportation construction industry.

What does this mean for construction contractors? It means more jobs that can bid at higher prices -- prices that match the actual current costs of construction materials and labor. Later in the cost-bid gap section, you will learn why these investments are so important right now.

Rising Costs of Materials and Fuel Causing Construction Inflation

Construction material pricing have continued to rise over the last two years, and economists predict even more inflation this year. According to recent estimates, material prices are the highest they have been in 35 years.

In particular, diesel, steel, aluminum, lumber, copper, asphalt, and plastic products are at their highest prices and are driving the construction inflation.

The price of diesel was up 33% to reach a record high of $5.25 per gallon in March. This means it costs more to deliver supplies AND more for construction companies to fuel and use the equipment for their projects. Overall, the high diesel prices lead to an increase in the total construction costs.

The soaring prices are due to a number of things including supply shortages, long lead times, space shortages, and errors. On top of that, the consumer price index in March 2022 jumped 8.5% - the highest spike since 1981.

Cost-Bid Gaps

Bids for construction jobs are not keeping pace with inflation. For example, bid prices are only up 17% while overall construction costs are up 22% or more. This has led to what is known as the cost-bid gap.

The cost-bid gap means construction contractors have to eat costs and end up with little to zero profit. Accurate cost management and documentation, including certified payroll reporting, are essential to mitigate losses.

Bipartisan Infrastructure Law

The Bipartisan Infrastructure Law went into effect on November 15, 2021. The objective of the law is to create approximately 800,000 jobs through investments in infrastructure including transportation, communications and utilities, and environmentally-sustainable developments.

All construction projects funded by the Bipartisan Infrastructure Law are subject to the Davis-Bacon Act. The DBA requires that employees are paid local prevailing wages and fringe benefits when working on federal construction or repair contracts. In addition, contractors must maintain and submit accurate records of all hours worked, wages paid, and benefits provided on a weekly basis.

Certified payroll reports ensure compliance. When reporting to the federal government, the WH-347 form is used. The reports include the employees' information: rate of pay, hours worked, fringe benefits, and tax withholdings.

These rights and regulations apply to employees working through subcontractors.

Failure to comply with the Davis Bacon Act can lead to fines and imprisonment, and may be subject to debarment from bidding on future government contracts for up to three years. In addition, contract payments could be withheld to pay for unpaid wages, liabilities, and liquidated damages.

Read more on the importance of keeping up with prevailing wages.

Recent Updates to the Davis-Bacon Act Regulations

The U.S. Department of Labor has submitted amendments to the Davis-Bacon Act (DBA) in favor of workers and unions.

The changes include changing the definition of "prevailing wage", where the prevailing wage will be the weighted average wage that is paid to the majority of workers in the specific category of labor.

In addition, the new regulations can adopt state and local prevailing wages (rather than just federal).

The amendments also allow off-site work to be included as a valid portion of the labor that receives the prevailing wage. Plus, truck and delivery drivers are now protected under the DBA as well.

California's and New York's Newest Inspection Compliance Regulations

In addition to federal changes, California and New York have implemented new state regulations.

In California, the new inspection compliance rules ensure that employees are provided with worker's compensation insurance. In addition, companies must adhere to labor laws including workplace health and safety rules, apprenticeship standards, and skilled and trained workforce requirements.

Of course, workers must be paid the minimum wage determined by the department of industrial relations based on the job type and property location.

The new initiatives were designed with the goal that construction workers will face zero negative impacts from working on publicly funded sites.

New York passed a state law on January 4th, 2022 that makes general contractors responsible for ensuring all employees are paid correctly and responsibly, including subcontracted employees. The goal is to prevent wage theft (the term used when employees are paid below the minimum wage), which remains a large issue throughout the country, especially among migrant workers.

Stay Compliant With Government Construction Contracts With Certified Payroll Reporting

Staying up-to-date with the government construction trends can be tough and time-consuming. But not knowing about changes to regulations can lead to non-compliance and costly consequences. Luckily, with certified payroll reporting services, you don't have to worry.

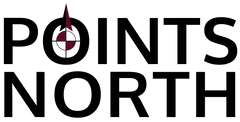

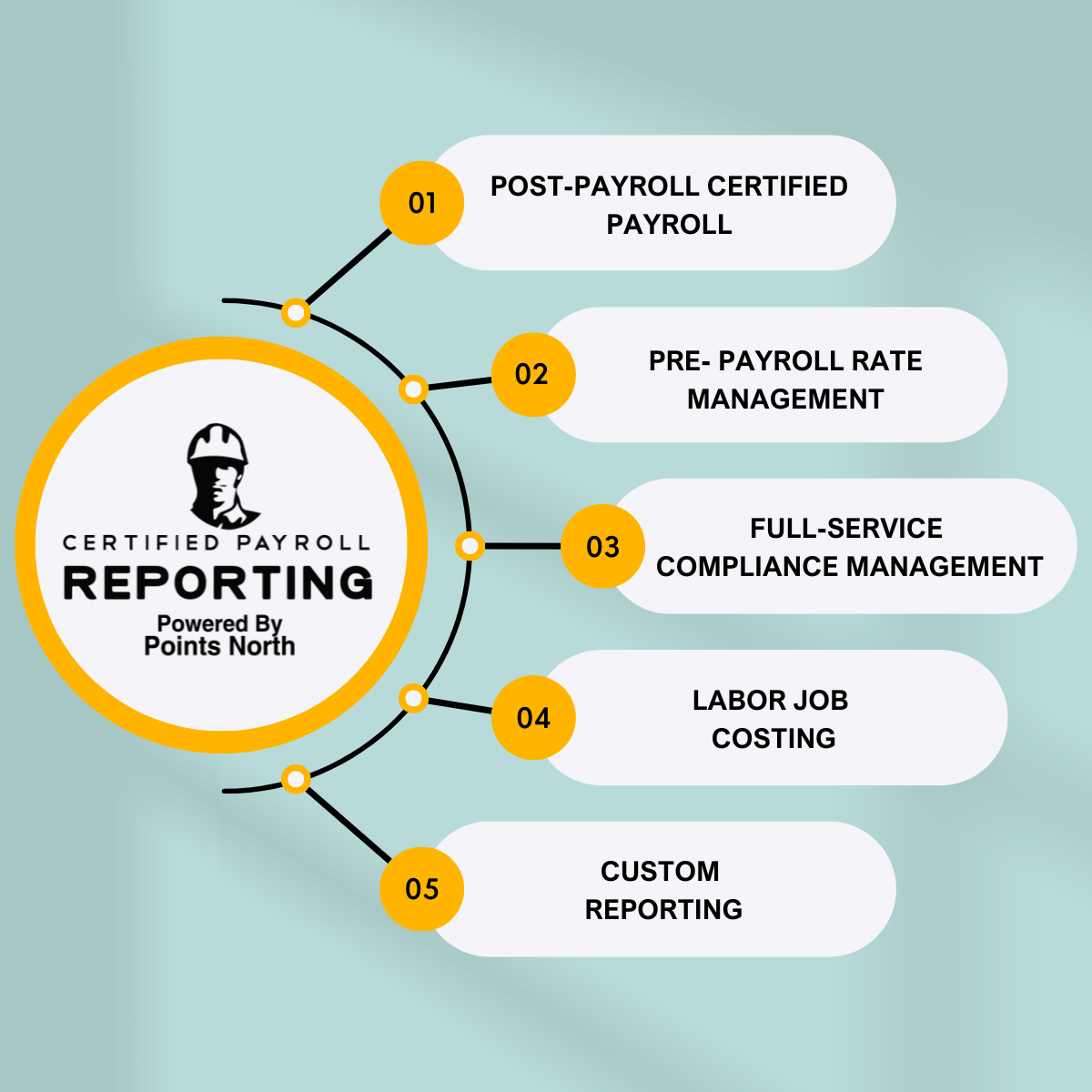

At Points North, we stay on top of the industry requirements and changes for you so you can focus on your business. We handle all your payroll needs including certified payroll support as well as ACA tracking and reporting.

Plus, we specialize in construction payroll and tracking. So, you can rest assured we are experts in the construction industry.

Read about our case studies here and contact us today to speak to a representative about how we can help your business and your bottom line.

.png)